What is ESG Investing and Why is It So Important?

Global climate sustainability and the health of our future planet is becoming increasingly important throughout society. Sustainability Investing reflects this consciousness and is a growing trend within markets. Small individual investors right through to institutional investors consider ESG scoring before making investment decisions. ESG stands for Environmental, Social, and Governance and it relates to investment funds. ESG metrics are not part of companies’ standard financial reports, but many are starting to issue corporate responsibility or sustainability reports as part of a growing trend. A good ESG score may not be sufficient to justify investing in a certain company, but a bad one can be a red flag for increased risks. [1]

ESG Investing and Risk Evaluation

Indeed, ESG is not just a fancy label, it is a part of the overall investment risk evaluation. This in turn is indicative of the risks in investing in a certain company or sector. For example, a badly run company (Governance issues) is likely to show decreased performance in the long run. Alternatively, a company with a good reputation for operating in a socially and environmentally sustainable manner is likely to grow in the future. Investments which score strong on the ESG assessment have been reported to outperform other investments (World Economic Forum. ‘Sustainability and profitability can co-exist. Here’s how.’ 7 January 2020).

Companies with a better ESG track record:

- produced higher three-year returns,

- were more likely to become high-quality stocks,

- were less likely to have large price declines,

- and were less likely to go bankrupt

How Do We Measure ESG Investing?

ESG issues are often highlighted by news media when investors suffer sudden and substantial losses on listed equities—losses that are attributed to poor management of risks posed by one or more of these ESG issues.

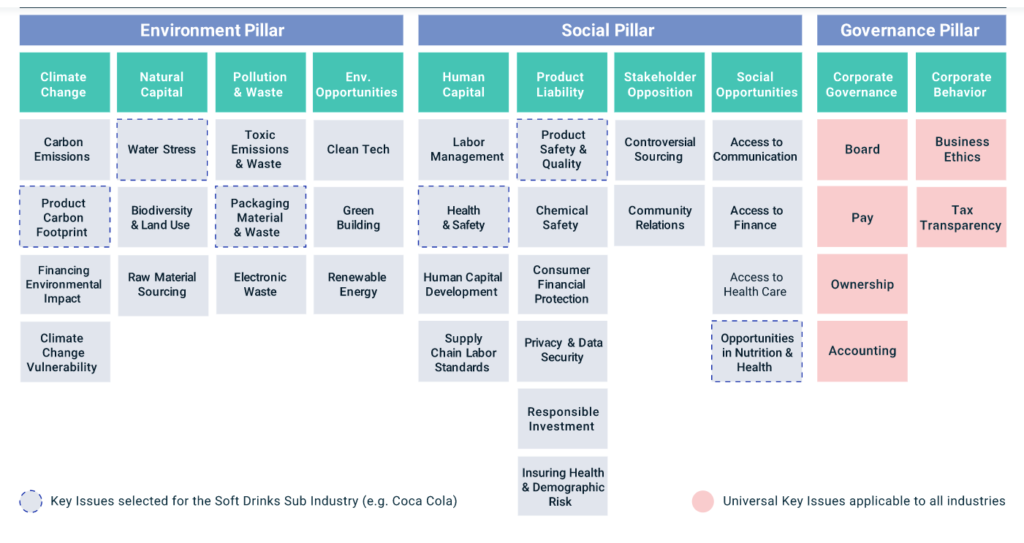

There is no one exhaustive list of ESG issues. ESG issues are often interlinked, and it can be challenging to classify an ESG issue as only an environmental, social, or governance issue. These ESG issues can often be measured (e.g., the employee turnover at a company), but it can be difficult to assign them a monetary value (e.g., the cost of employee turnover at a company). One of the most popular issuers of ESG scoring within the markets today is MSCI. They rank companies on the basis of social, environment and government factors. [2]

The framework below deals with the firm Coca-Cola, illustrating Issues specific to Coca Cola and the issues applicable across all different industry.

Source: MSCI ESG Ratings Key Issues Framework [3]

What Should You Watch Out for When Investing in ESG Funds?

Investment managers use a number of methods to evaluate investments. These methods are only guidelines and an evolving concept. However, since the Covid pandemic, an ESG evaluation is becoming a standard part of the risk assessment of investments. Investment managers will often apply the different methods together, i.e. exclude investing in tobacco and alcohol companies, and use thematic investing in sustainable forestry and clean tech. [1]

Exclusionary Screening

This type of ESG screening avoids investing in companies or countries on the basis of traditional moral values (e.g., products or services involving alcohol, tobacco, or gambling) and standards and norms (e.g., those pertaining to human rights and environmental protection).

Best-in-Class Selection

Best-in-class selection refers to preferring companies with better or improving ESG performance relative to sector peers. This method employs positive selection unlike the exclusionary screening.

Active Ownership

Active ownership refers to the practice of entering into a dialogue with companies on ESG issues and exercising both ownership rights and voice to effect change. Engagement with a company could be for monitoring or influencing outcomes and practices regarding ESG issues.

Thematic Investing

Thematic Investing refers to investing in sectors which feature ESG issues. For example, ESG thematic investing may include clean tech, green real estate, sustainable forestry, agriculture, education, and health.

Impact Investing

Impact investing suggests investing with the disclosed intention to generate and measure social and environmental benefits alongside a financial return.

ESG Integration

ESG integration refers to the inclusion of ESG risks and opportunities in the investment analysis of a company. For example, a company which is not environmentally sustainable may be hit with penalties or reduced market opportunities which can negatively impact its performance and growth.

Greenwashing

As sustainability becomes a bigger factor amongst consumers and investors when making investment decisions, more and more companies are spending money to ensure they give them impression that they are “green”. In some cases, some firms may spend more money to ensure they appear sustainable, than they spend on being sustainable. This is called “green washing”. Do not just look at the reports, but also ask what the company actually does. One company that was recently exposed for greenwashing was Volkswagen. A well-known car manufacturer who admitted to falsifying its vehicles’ emissions by putting a “defeat” device in the car which changes the cars emissions under testing. This shows that even though a company appears sustainable, it may not be. [4]

ESG Investing – Examples of Sustainable Investment Funds

New Ireland Alternative Energy Fund

New Ireland employs 6 principles of responsible investing to ensure that sustainable funds comply with the ESG framework. These include policies and practices transparency from firms they choose to invest in. [5]

32.7% growth annualized for past three years.*

€20,000 invested would be worth €46,735.06 after 3 years. (Investment growth subject to 41% exit tax)

*Warning: Past performance is not a reliable guide to future performance. Benefits may be affected by changes in currency exchange rates. The value of your investment may go down as well as up. If you invest in these products you may lose some or all of the money you invest.

Standard Life Ethical Fund

Standard life has a screening process that allows them to adhere to sustainable investment criteria. They base their decision-making process on two factors – ESG incorporation and Stewardship. ESG incorporation refers to screening, and thematic investing. Stewardship refers to how a company engages with share holders through proxy voting, and also monitoring how these companies engage with ESG principles.

Aberdeen standard investments manage the majority of Standard Life’s fund choices in this area. An Example fund is the Standard Life Ethical Fund which returned 33.9% over the last year. [6]

€20,000 invested would be worth €26,780 after 1 year*. (Investment growth subject to 41% exit tax)

*Warning: Past performance is not a reliable guide to future performance. Benefits may be affected by changes in currency exchange rates. The value of your investment may go down as well as up. If you invest in these products you may lose some or all of the money you invest.

Cantor Fitzgerald

Another example of an ESG investment bond available to Irish investors is the Cantor Fitzgerald ESG 85% Progressive Protection Bond. This bond generates returns linked to an innovative ESG multi-asset Fund index, whilst ensuring a minimum protected value for investors. The bond features 2 Leading ESG / SRI funds with 5 Star ratings from Morningstar – Robeco Sustainable Global Stars Equities Fund & Allianz Euro Credit SRI Fund. These funds will not invest in companies exposed to military contracting, or controversial weapons, firearms, UN Global Compact breaches, tobacco, palm oil, nuclear power, thermal coal, arctic drilling and oil sands. [7]

For more information and if you are interested to invest, request your free investment & savings plan options with MadeSimple.

References:

-

ENVIRONMENTAL, SOCIAL, AND GOVERNANCE ISSUES IN INVESTING A Guide for Investment Professionals (2015) CFA Institute https://www.cfainstitute.org/-/media/documents/article/position-paper/esg-issues-in-investing-a-guide-for-investment-professionals.ashx

-

MSCI ESG Ratings https://www.msci.com/our-solutions

-

MSCI ESG Ratings Key Issues Framework

-

Kenneth Partridge (2015) VW Scandal Just the Tip of the Greenwashing Iceberg https://www8.gsb.columbia.edu/articles/ideas-work/vw-scandal-just-tip-greenwashing-iceberg

-

New Ireland Sustainable Investing https://www.newireland.ie/broker/sustainableinvesting/

-

Standard Life ESG Funds https://www.brokerzone.ie/investment-options/esg-funds

-

Cantor Fitzgerald ESG 85% Progressive Protection Bond https://cantorfitzgerald.ie/wp-content/uploads/2021/06/ESG-85-Progressive-Protection-Bond-Brochure.pdf

What Does the Financial Planning Review Cover?

Step 1

You – Complete a short online application form

Step 2

We – Generate your personal report that outlines your current benefits.

Step 3

Together – We schedule a review online (we use Zoom, or a platform you may suggest) or over the phone to discuss what options are available to you.

After we complete the review, many employees are delighted to have their options regarding pension planning, salary protection, life protection, savings and investments explained to them so clearly. Not only that, but we can also set up policies for you all online in a very fast and efficient manner.

Get your complimentary, personalised review today! You have nothing to lose!