Public Sector Pensions

The Irish Public Sector provides employment to around 13% of the Irish workforce. These employees get Public Sector Pensions as part of their employee benefits. We work closely with the HSE, local government offices, third level education institutions and schools to cater to their employees’ very specific financial needs. There are specificities to the retirement planning and protection of Public Sector employees in every country. It is important to get financial advice from local experts who keep abreast of current changes in legislation and are familiar with public sector schemes in Ireland.

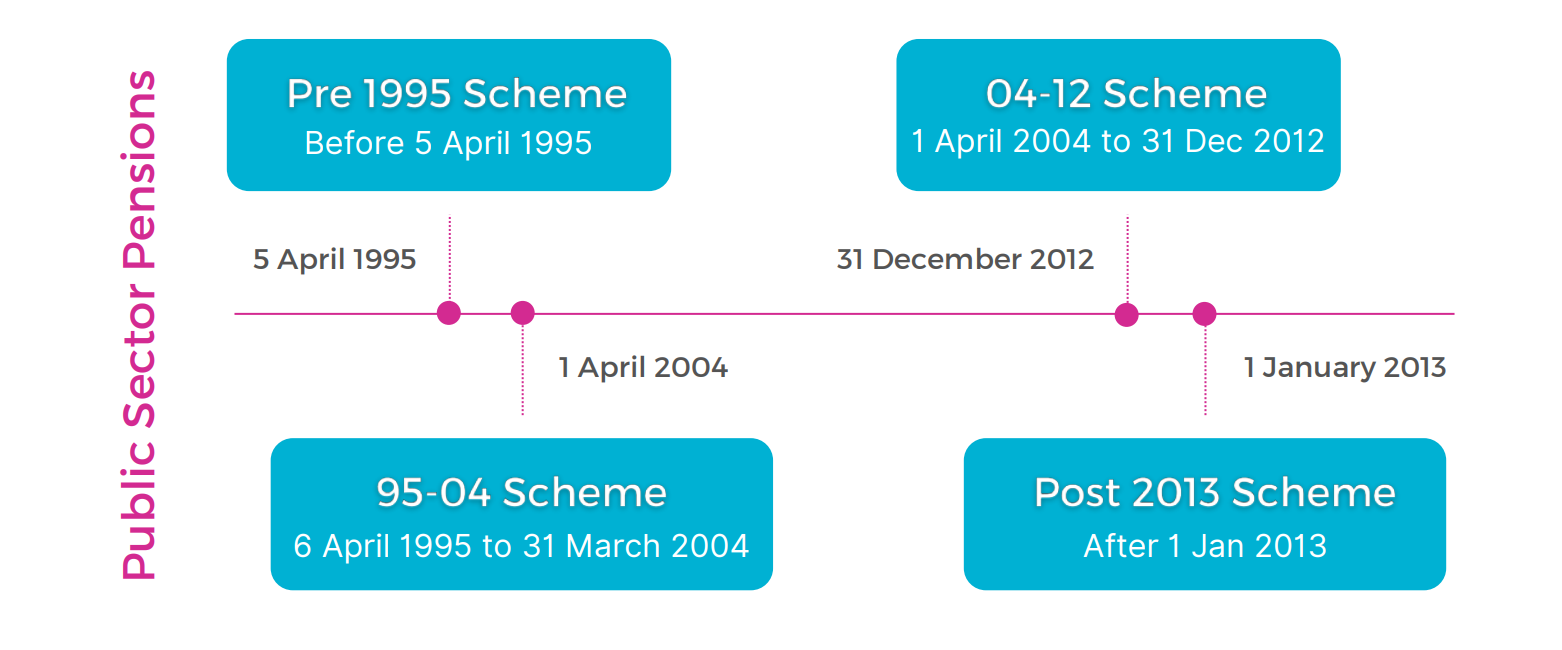

Public Sector Pension Schemes

Public Sector Superannuation rules have been changing over the years resulting in four different “Pension Schemes”. Hence, the date an employee entered public sector service is a determinant of the contributions they pay and the benefits they will receive. However, breaks in service longer than 6 months will render an employee a new entrant when they resume service.

This can result in benefits being accrued in different pension schemes. It is important that public sector employees are clear about their scheme and benefits for best financial planning. We often meet with public sector employees who are not even sure which pension scheme they are in. Often, employees could have breaks in service or received pension contribution refunds.

Basic Benefits of Public Sector Pension Schemes

The public sector superannuation schemes all provide some basic benefits including sick pay, death-in-service benefit, annual pension at retirement and a tax free lump sum. The amount of benefits received by each member are determined by the years of service, salary and retirement age. However, there are some marked differences between the schemes in how benefits are calculated.

Tax Free Lump Sum (TFLS)

All public sector employees in Ireland receive at retirement a Tax Free Lump Sum (FTLS). This lump sum incurs no tax up the amount of €200,000.

Annual Pension

In addition to the FTLS, public sector employees receive a pension at their Normal Retirement Age (NRA). The amount of pension received at retirement is calculated differently for Pre 2004, 2004 – 2012 and Post 2013 Entrants. All four schemes are Defined Benefit Schemes, but the pre 95 is based on final salary only and not integrated with the Irish Contributory State Pension (CSP).

Sick Pay and Ill Health Early Retirement (IHER)

- Sick pay – 92 days full pay in any year, 91 days half-pay in any year, subject to a maximum of 183 days in any 4 year period.

- Public Sector Employees who have to pension on IHER receive a pension based on years service and salary. They have to have been a member of the scheme for a minimum of 2 years.

Death-in-Service Benefit

Scheme members receive a Death Gratuity which is paid out similar to a life insurance. Furthermore, the death-in-service benefit provides for a spouse’s pension and children’s pension.

More on Public Sector Pensions

Superannuation Benefits

A summary of the public sector superannuation benefits for each of the four pension schemes in Ireland.

Public Sector Pension Schemes Explained >>

What Does the Financial Planning Review Cover?

Step 1

You – Complete a short online application form

Step 2

We – Generate your personal report that outlines your current benefits.

Step 3

Together – We schedule a review online (we use Zoom, or a platform you may suggest) or over the phone to discuss what options are available to you.

After we complete the review, many employees are delighted to have their options regarding pension planning, salary protection, life protection, savings and investments explained to them so clearly. Not only that, but we can also set up policies for you all online in a very fast and efficient manner.

Get your complimentary, personalised review today! You have nothing to lose!